We invest thematically in high-quality assets, focusing where we see outsized growth potential driven by global economic and demographic trends.

1. Tailored Solutions:

Our 401(k) investment services are crafted to meet the diverse needs of our clients. Whether you are a seasoned investor or just starting to plan for your retirement, we offer tailored solutions that align with your financial goals and risk tolerance.

2. Expert Guidance:

ASBC Global boasts a team of seasoned financial professionals who bring a wealth of experience to guide you through the intricacies of 401(k) investing. Our experts are dedicated to helping you make informed decisions and navigate the ever-changing landscape of retirement planning.

3. Diverse Investment Options:

We understand that every investor has unique preferences. Our 401(k) program provides a range of investment options, allowing you to create a diversified portfolio that suits your individual preferences and financial objectives.

4. Transparent Fee Structure:

Transparency is at the core of our philosophy. ASBC Global ensures a clear and transparent fee structure for our 401(k) investment services. You can have peace of mind knowing that your investments are managed with efficiency and integrity.

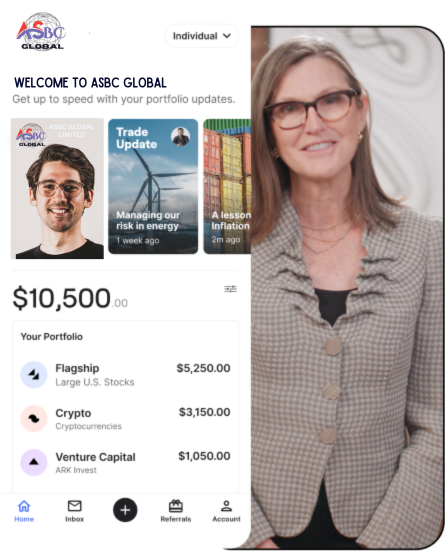

5. Technology-Driven Solutions:

Embracing the latest technological advancements, ASBC Global provides user-friendly online tools and resources. Monitor your 401(k) investments, track performance, and access educational materials to enhance your financial literacy.

Opportunistic

Our opportunistic business seeks to acquire undermanaged, well-located assets globally. In tandem with acquisitions, we establish businesses designed to manage these assets, enhance their value through best-in-class management, and ultimately deliver returns to our limited partners. For 401(k) investors, our opportunistic strategies aim to capitalize on real estate opportunities that align with retirement income objectives.

Core+

The Core+ business at ASBC Global focuses on stabilized real estate with a long investment horizon and moderate leverage. Our strategies, spanning North America, Europe, and Asia, target logistics, residential, office, life science office, and retail assets in global gateway cities. Additionally, our Core+ Real Estate business includes ASBCReal Estate Income Trust, Inc. (IREIT), a non-listed REIT tailored for individual investors, focusing on income-generating assets in the U.S. and U.K. This diversification is crucial for 401(k) participants seeking stable and income-generating investments.

Debt

ASBC Global's real estate debt business offers creative and comprehensive financing solutions across the capital structure and risk spectrum. Originating loans and investing in debt securities underpinned by high-quality real estate, we manage ASBC Global Real Estate Mortgage Trust (STSE: RVMT), a leading real estate finance company originating senior loans collateralized by commercial real estate. In the context of 401(k) investments, our real estate debt strategies provide opportunities for fixed-income exposure within retirement portfolios.

At ASBC Global, we are dedicated to providing robust and strategic 401(k) investment opportunities within the realm of Real Estate Investment Trusts (REITs). Our approach ensures that retirement portfolios are well-positioned to navigate the complexities of the real estate market while striving for long-term financial success for our investors.

We invest thematically in high-quality assets, focusing where we see outsized growth potential driven by global economic and demographic trends.

Conviction

Our vast portfolio provides us with proprietary information across every major real estate asset class in virtually every major market around the world, allowing us to identify themes and invest capital with conviction.

Connectivity

Our people are our advantage. Our team of nearly 600 real estate professionals across 9 offices operates as one globally integrated business, allowing us to identify the opportunities and limits of each potential transaction through one investment review process.

Scale

Scale is one of our greatest strengths. The breadth of our existing portfolio gives us differentiated perspectives across sectors and geographies, while our significant discretionary capital base enables us to execute large and complex transactions.

Our Strategies

Since we started investing in real estate in 2016, the growth of our business across both products and geographies has expanded our ability to provide practical and diverse solutions to our limited partners. We have invested successfully through all market cycles and across the entire risk spectrum.

Opportunistic

Our opportunistic business seeks to acquire undermanaged, well-located assets across the world. In connection with these acquisitions, we build businesses that are set up to manage the underlying properties and ultimately maximize their value by instituting best-in-class management. Post-acquisition, we also invest in the properties to improve them before selling the assets and returning capital to our limited partners.

Core+

Our Core+ business features stabilized real estate with a long investment horizon and moderate leverage, where we can unlock additional value through focused asset management. Our North America, Europe and Asia strategies focus on logistics, residential, office, life science office and retail assets in global gateway cities. Our Core+ Real Estate business also includes ASBC Real Estate Income Trust, Inc. (IREIT), a non-listed REIT tailored for individual investors and focused on income-generating assets primarily across the U.S & U.K.

Debt

Our real estate debt business provides creative and comprehensive financing solutions across the capital structure and risk spectrum. We originate loans and invest in debt securities underpinned by high-quality real estate. We manage ASBC Global Mortgage Trust (STSE: RVMT), a leading real estate finance company that originates senior loans collateralized by commercial real estate.