Investing in innovation starts with understanding it.

If your question doesn’t appear below, please contact us: support@asbcglobal.com

Even before launch, we have built a network with top-tier venture capital funds globally, as we believe our value proposition complements that of traditional venture capital funds. We believe ASBC' long-term investment outlook and platform to enable companies to tell their story to the world is unique and appreciated by other venture capital firms.

Partnership companies can tap into ASBC' years of proprietary research expertise and network of co-investors, public and private companies, founders, and academics. They also benefit from ASBC’ brand awareness among retail investors and social media presence.

As an evergreen public-private crossover fund, the ASBC Global Limited can hold shares of companies throughout their private and public market lifecycle, from early stage to potentially mega cap, without the need to sell out after private company initial public offerings (IPOs).

ASBC Global can increase exposure in newly public portfolio companies through the Asbc Global ETFs and other public equity strategies dependent on investment strategy and corresponding selection criteria.

Companies that the ASBC Global Limited invests in can tap into ASBC' years of proprietary research expertise and network of co-investors, public and private companies, founders, and academics. They also benefit from ASBC brand awareness among retail investors and social media presence.

As an evergreen public-private crossover fund, the ASBC Global Limited can hold shares of companies throughout their private and public market lifecycle, from early stage to potentially mega cap, without the need to sell out after private company initial public offerings (IPOs).

ASBC can increase exposure in newly public portfolio companies through the ASBC ETFs and other public equity strategies dependent on investment strategy and corresponding selection criteria.

Unlike traditional venture capital funds, our fund is open to investors regardless of accreditation or qualification. In addition, the Fund offers 5% liquidity on a quarterly basis, so investors are not locked up for longer periods like in traditional venture capital funds.

We believe our differentiated value proposition combined with our network of co-investors, public companies, founders, and academics provides access to the most promising private technology companies.

We believe our single 2.75% management fee is more cost-effective than traditional venture capital funds under the ”2 and 20” model (2% management fee, 20% carried interest).

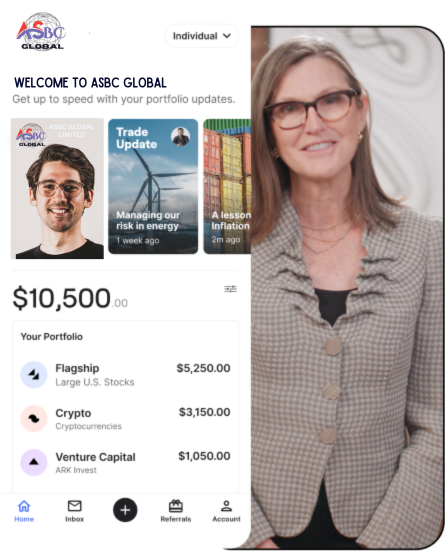

Our research team covers both public and private companies. Our venture capital investment committee includes our CIO Cathie Wood, and ASBC Global Limited Investment Committee Members Brett Winton, Max Friedrich and Will Summerlin.

We do not plan on taking board seats. Besides our core value add of being a true long-term investor, we provide access to our ecosystem of public and private companies, co-investors, retail investors, and academics.

Investors get exposure to the entire active portfolio regardless of when they invest.

The product is a closed-end regulated mutual fund, and as such, each investor will receive a 1099 DIV at year end which will identify their taxable distributions, if applicable.

The ASBC Global Limited will be available to international investors.

We believe the current valuations present an attractive entry point for innovation broadly. According to our research, disruptive innovation will create more than $200 trillion in global enterprise value during the next decade. Startups and venture capitalists are likely to capture a significant share of that value creation.

Additionally, our public-private structure allows us to take advantage of occasional arbitrage opportunities created by significant valuation dislocations.

Earnings of the fund’s total assets can be redeemed weekly. If cumulative redemption requests are of total fund assets, investors would receive 100% of their requested amount. If cumulative redemption requests are over total fund assets, investors would receive a pro-rata portion of their requested amount, depending on the redemption demand of other investors.

Investors can request redemptions on a Weekly basis. Earnings of the fund’s total assets can be redeemed weekly.

Generally, active investments on ASBC Global are not liquid. Once your investment has been fully processed, you cannot cancel your investment for the remaining duration of the offering. You can however choose to terminate your investment but the service charge must be paid in full. Your investment is considered fully processed after we’ve delivered the countersigned investment documents, verified your accreditation status, and received your payment.

We may invest in venture capital funds that we believe provide access to differentiated private company portfolios.

Even before launch, we have built a network with top-tier venture capital funds globally, as we believe our value proposition complements that of traditional venture capital funds. We believe ASBC' long-term investment outlook and platform to enable companies to tell their story to the world is unique and appreciated by other venture capital firms.

Partnership companies can tap into ASBC' years of proprietary research expertise and network of co-investors, public and private companies, founders, and academics. They also benefit from ASBC' brand awareness among retail investors and social media presence.

As an evergreen public-private crossover fund, the ASBC Global Limited can hold shares of companies throughout their private and public market lifecycle, from early stage to potentially mega cap, without the need to sell out after private company initial public offerings (IPOs).

ASBC can increase exposure in newly public portfolio companies through the ASBC ETFs and other public equity strategies dependent on investment strategy and corresponding selection criteria.

We actively source deals from our network of co-investors, public companies, founders, and academics. Additionally, our Analysts identify potential investment targets.

Companies go through a rigorous due diligence process, including discussions with the company, reference calls, financial modelling and are being scored on ASBC' proprietary five scores, people management and culture, product leadership, barriers of entry, ability to execute and thesis risk.

Unlike traditional venture capital funds, our fund is open to investors regardless of accreditation or qualification. In addition, the Fund offers 5% liquidity on a quarterly basis, so investors are not locked up for longer periods like in traditional venture capital funds.

We believe our differentiated value proposition combined with our network of co-investors, public companies, founders, and academics provides access to the most promising private technology companies.

We believe our single 2.75% management fee is more cost-effective than traditional venture capital funds under the ”2 and 20” model (2% management fee, 20% carried interest).

Inflows are initially invested into public equities.

The total number of positions is dependent on fund AUM and inflows, but under normal circumstances, the Fund expects to invest 20% – 85% of its assets in securities of private companies and the remainder of its assets in publicly traded securities.

Initial investments into private companies will change depending on overall assets under management (AUM) and inflows, but we anticipate initial check size to range from $500k to $20mm.

We anticipate early-stage opportunities to represent 0-25% of the fund while late-stage private opportunities represent 50-80%.

We would reinvest the proceeds.

The fund differs from traditional venture capital funds in multiple ways:

As of March 31, 2023, the ASBC Global Limited will have reduced expenses thanks to its Expense Limitation Agreement with ASBC Global Limited, the Fund’s investment adviser (the “Adviser”). This means that the fund’s management fee and operating expenses may be waived or reimbursed by the Adviser if they exceed 2.90%, which will result in lower expenses for the Fund. Additionally, the Adviser has agreed to voluntarily reimburse the Fund money to ensure that all existing investors will also benefit from reduced Fund expenses. Finally, the Fund’s Distribution and Service Plan has been amended to reduce the compensation paid to the Distributor.

Investors get exposure to the entire active portfolio regardless of when they invest.

The product is a closed-end regulated mutual fund, and as such, each investor will receive a 1099 DIV at year end which will identify their taxable distributions, if applicable.

We may invest in venture capital funds that we believe provide access to differentiated private company portfolios.

Investment decisions are made by our research team and investment committee, and investors in the fund receive exposure to a portfolio of companies rather than a single company. In general, we believe the best private companies eschew crowdfunding.

Unlike traditional venture capital funds, our fund is open to investors regardless of accreditation or qualification. In addition, the Fund offers 5% liquidity on a quarterly basis, so investors are not locked up for longer periods like in traditional venture capital funds.

We believe our differentiated value proposition combined with our network of co-investors, public companies, founders, and academics provides access to the most promising private technology companies.

We believe our single 2.75% management fee is more cost-effective than traditional venture capital funds under the ”2 and 20” model (2% management fee, 20% carried interest).

Starting a fund at $20 per share is very common and low enough to allow smaller investors the entry point they need to make an investment.

Our strategy is governed by both total AUM and quarterly inflows. We may modify target check size and increase or decrease number of investments to account for fluctuations in flows. We may temporarily close the fund to new investors if we feel we are at risk of raising more capital than we can effectively allocate.

The total number of positions is dependent on fund AUM and inflows, but under normal circumstances, the Fund expects to invest 20% – 85% of its assets in securities of private companies and the remainder of its assets in publicly traded securities.

Public equities are priced daily, while the fair value of private assets is assessed on a quarterly basis by our valuation committee with input from an independent third-party valuation firm. Under certain circumstances, such as a new funding round, we may adjust the fair value of a private asset intra quarter.

Initial investments into private companies will change depending on overall assets under management (AUM) and inflows, but we anticipate initial check size to range from $500k to $20mm.

Under normal circumstances, the Fund expects to invest 20% – 85% of its assets in securities of private companies and the remainder of its assets in publicly traded securities. This ratio can change, for example if we believe there are valuation discrepancies between the public and private market which the fund, as a crossover fund, can exploit. The selection criteria incorporates both our top-down research and bottom-up analysis, and is focused on liquid public equities.

The ASBC Global Limited has the ability to hold public companies, and therefore can hold companies after initial public offering (IPO).

Under normal circumstances, the Fund expects to invest 20% – 85% of its assets in securities of private companies and the remainder of its assets in publicly traded securities.

This fund is an evergreen strategy. We believe the best companies tend to generate outsized returns beyond the typical ten-year fund life. Whereas venture capital investors take advantage of companies’ value creation in the private market, and public equity investors of companies value creation in the public markets, as an evergreen cross-over fund, the ARK Venture fund participates in companies’ value creation throughout their life cycle, from early stage in the private, to potentially mega cap in the public markets.

Investing in innovation from early stage through mega cap

The ASBC Global Limited seeks to democratize venture capital, offering all investors access to what we believe are the most innovative companies throughout their private and public market lifecycles.

We believe all investors should have access to venture capital, cutting-edge research, impactful education, and a phenomenal user experience. Create an account and get started today.